by Joe Clark | Oct 24, 2019 | Blog, Investments, Life Happens

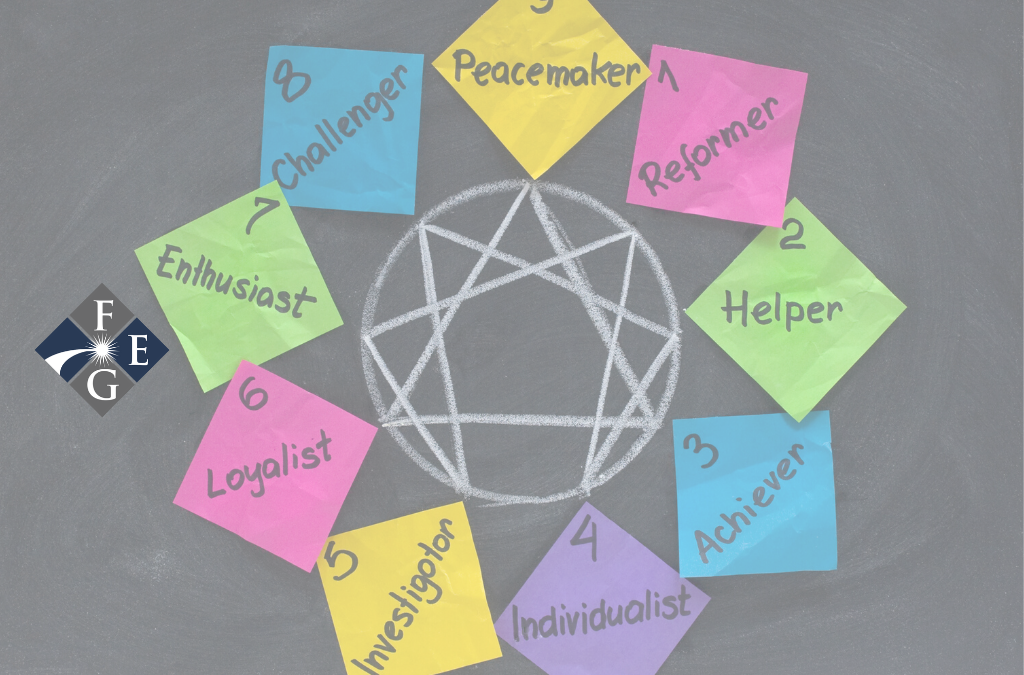

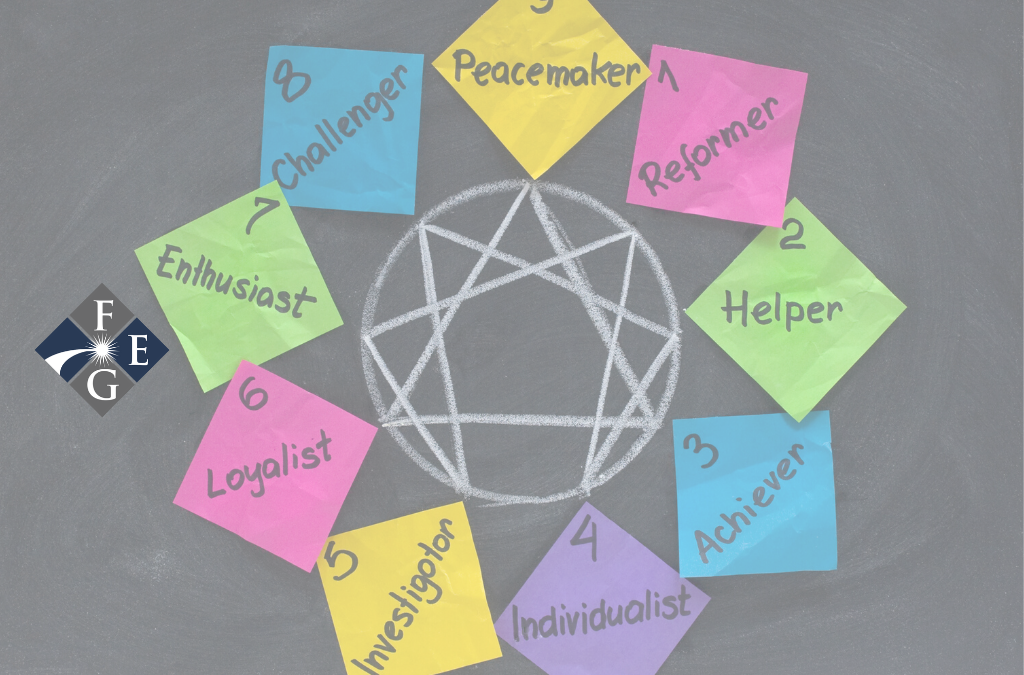

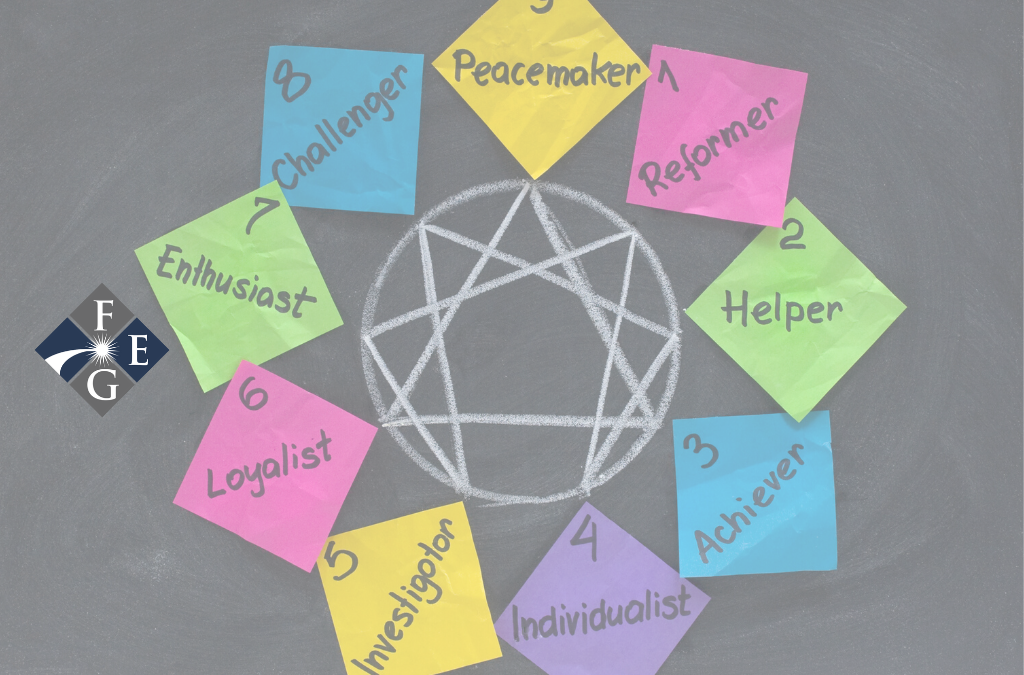

This year I introduced my family to the Enneagram. The last 52 years of life seems to have come to pass without a moments recognition of this wonderful tool. The Enneagram is believed to be a 2,000 year old tool that explains from a personality perspective who we are...

by Joe Clark | Oct 24, 2019 | Blog, Investments, Legacy Planning, Life Happens

How often have you sat in the doctor’s office with an ailment that you don’t mention? Going to the doctor and not telling the truth is not only counterproductive but can be quite dangerous. The same is true with your financial advisor — many aspects of the financial...

by Joe Clark | Oct 24, 2019 | Blog, Tax Planning

Diversification is commonly thought of as owning different investments. There is also the notion of not having all your money in one place or investment account. Diversification even occurs in alternating exercises or eating different food types. The concept has...

by Joe Clark | Oct 24, 2019 | Blog, Your Life After Work

Who doesn’t want to retire? More people than you may think including myself. The rational and reasons for continuing to work comes from the obvious “I love what I do” to “What would I do?” Our experience would suggest there is also a large contingency that is simply...

by Joe Clark | Oct 4, 2019 | Investments

Our educational system was founded on the notion that more information leads to better decision making. Perhaps at some point, this was true, but today I would beg to differ. That theory came from a time when our information was delivered by primarily three news...

by Joe Clark | Sep 26, 2019 | Blog, Investments

The art of comparison creates many challenges for our personal and professional lives but especially our finances. The desire to keep up with the “Jones’” next door in the newest car, biggest house and best vacation hopefully fades as we age. Other aspects of...

by Joe Clark | Sep 12, 2019 | Blog, Investments, Life Happens, Tax Planning, Your Life After Work

King Solomon famously wrote, “It is the little foxes that spoil the vine.” In a secular moment, he might have written: “it is the little assets that spoil the estate plan.” More often than not, with careful examination, we uncover forgotten assets in a family’s...

by Joe Clark | Sep 5, 2019 | Blog, Investments

Business CEOs and their boards must make many decisions: Where do they invest in their business? Do they add new business models, buy competitors or dive deeper into their niche? What do they do with leftover profits? Amid all of these questions, a key consideration...

by Joe Clark | Aug 28, 2019 | Blog, Investments, Your Life After Work

Have you ever noticed when you buy a car that it seems many other drivers suddenly made the same choice? It is often known as the Badder-Meinhof phenomenon otherwise known as frequency illusion or recency illusion. When you buy a new car, it might be frustrating, but...

by Joe Clark | Aug 15, 2019 | Blog, Investments

Do as I say not as I do! There are two schools of thought on what to do with a large single payment regarding investing. The math clearly states you are better off to invest the lump sum rather than put in money over time. The key is your holding period or how long...